Insured-Focused

Hazard-Based

Prevention Driven

“The best defense against loss is a knowledgeable and risk-aware insured.” – Patrick C. Schneider

Why RADAR?

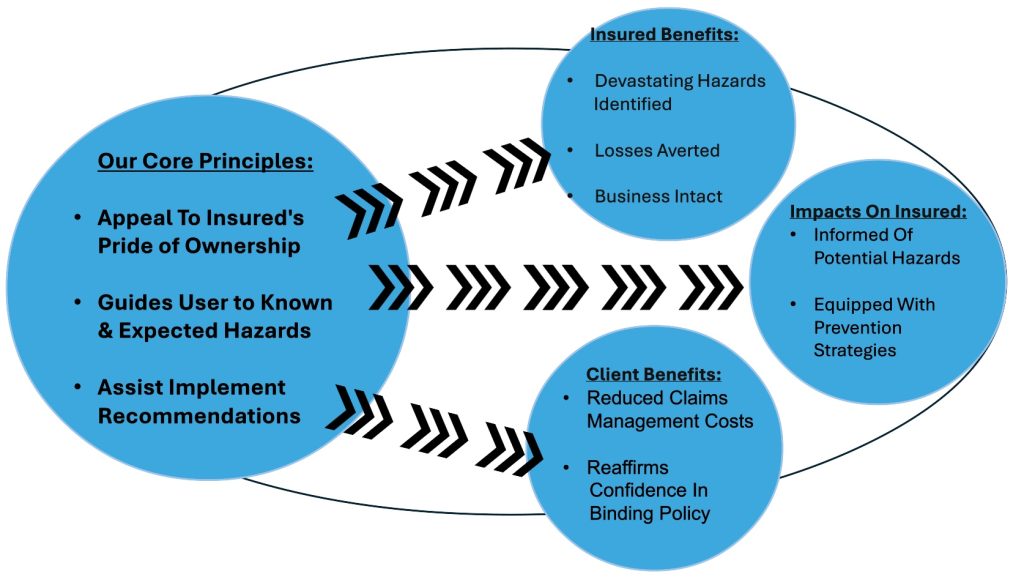

We recognize that insureds have the most to lose. Deductibles, injuries, out-of-pocket expenses, lost income, and even more significant intangible costs like time and frustration are all consequences of a loss. Assisting insureds prevent losses is our goal. Achieve it, then everyone involved, including Program Managers, Carriers, and Reinsurers, are rewarded.

Process Overview

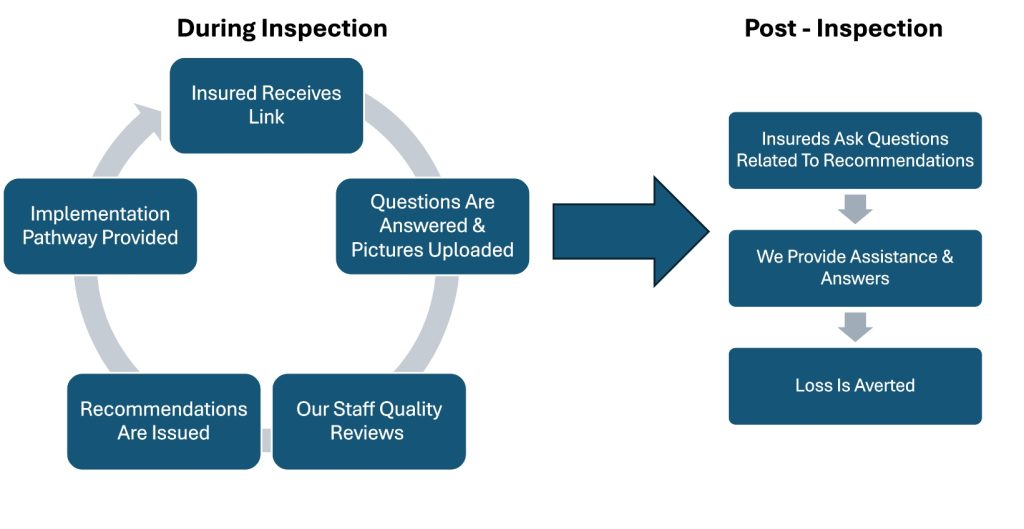

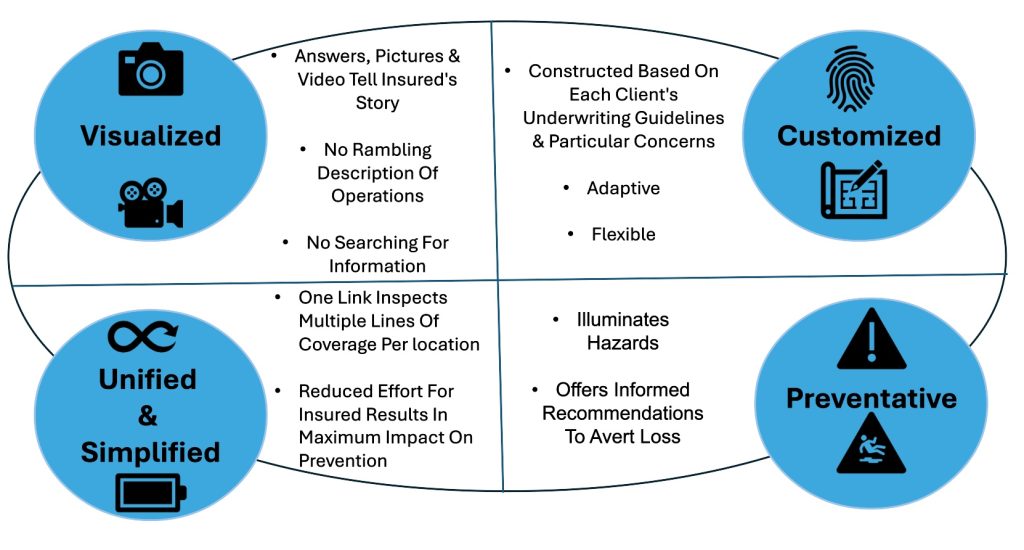

The RADAR process is a VISUALIZATION of the unique operations conducted and activities performed. Questions paired with pictures and video tell the story of each particular business. Underwriters reviewing finished reports experience the business firsthand from the insureds perspective.

Process Highlights:

- No Special Devices

- Self-Guided Via Link

- No Appointment Scheduling

- We’re Available To Answer Questions

Modus Operandi

Focus on the INSURED via assisting preventing losses and all participants during the policy’s lifecycle are rewarded. This generates dividends in the form of lower ratios, educated staff, less time spent on claims management and increased operational efficiency. Without focusing on the insured these benefits cannot be achieved.

Services

RADAR has simplified the inspection process to maximize the benefits of loss prevention. A single link can complete multiple inspections for differing lines of coverage. No longer does an insured have to schedule multiple appointments with different inspectors on various days and times.

Here are just a few of the coverages we can inspect.

- Auto

- Property

- General Liability

- Workers Compensation

Don’t see your coverage on the list? Give us a call and we will discuss customizing an inspection for your particular program.

Outperforming Physical Inspections

Here’s How

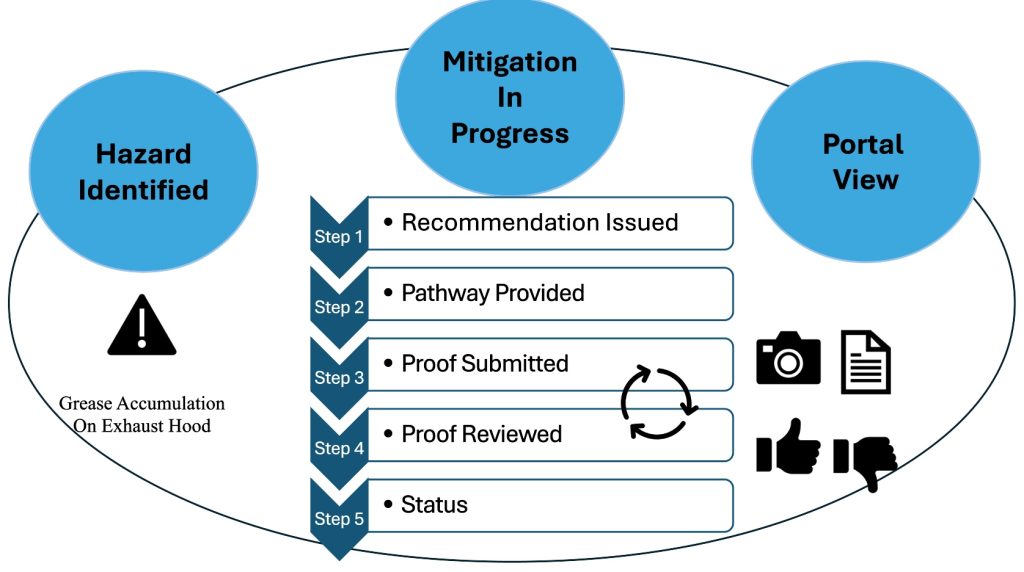

RADAR’s service doesn’t end once the insured presses submit. Recommendation Management has been introduced to achieve three goals.

- Identify Potential Hazards

- Assist Insureds Via Providing Implementation Resources

- Mitigate Hazards to Prevent Losses

After hazards have been identified, informed recommendations are issued to prevent losses. Here we invite insureds to benefit from our wealth of risk management resources to best understand hazards and implement controls. Awareness, detection and mitigation positively impact insureds and have a corresponding impact on the value of your portfolio.

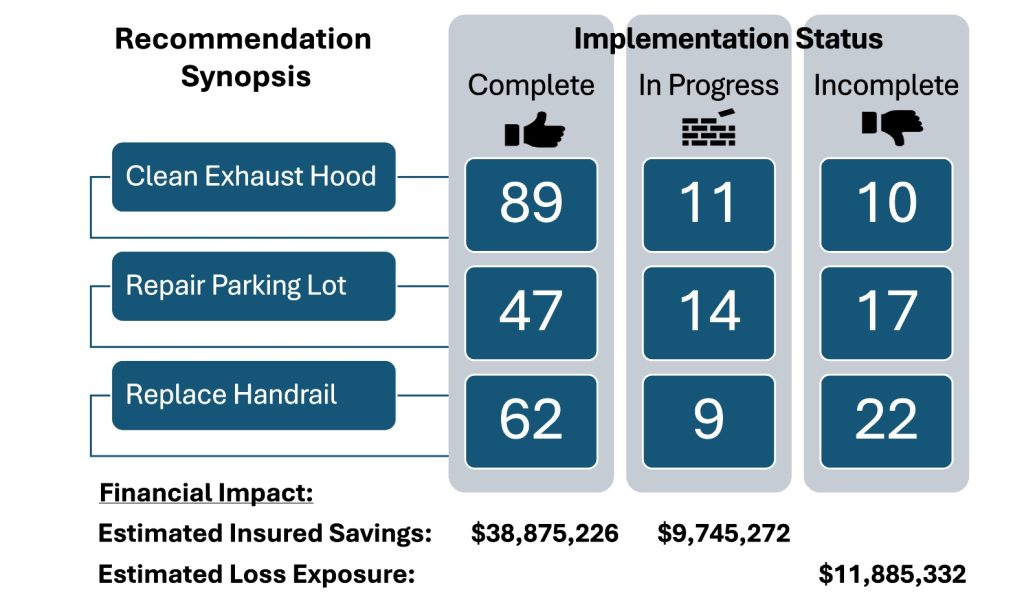

Portfolio Management achieves these goals.

- Visually Represents Recommendations Based On Completion Status

- Provides Monitoring & Tracking Until Successful Implementation

- Estimates Financial Impact To Stakeholders

Recommendations have a financial impact beyond the policyholder for whom they were issued. Our Recommendation Management module identifies hazards that have the potential to cascade throughout your portfolio. Recommendation instances are aggregated and monitored until effectively mitigated.

It’s important that recommendations be implemented promptly and properly. We understand that there might be questions or assistance required with this component of our service. That’s natural. Our team invites these opportunities to serve as a resource!

Philosophy. Methodology. Technology. In That Order

What we have developed is not merely a hazard mitigation tool focused on insureds. Instead our process serves to educate and inform new underwriters, agents and staff entering the insurance industry at all levels. A generational transformation is occurring in our field, and few are prepared to step into roles that require decades of mentoring and hard-fought experience. Technology can ease this transition however it will not do so alone.

RADAR merges a unique loss control philosophy with an ideology focused around the insured. This is unheard of in today’s field of physical loss control where the incentive exists to push out inspections with little to no regard for accuracy, consistency or the insureds wellbeing. Unlike a field where pay is prioritized over quality RADAR has paired technology with a philosophy and methodology that was honed via twenty years performing commercial inspections. Our objective is to prevent incidents from becoming accidents, and accidents from becoming claims. This can only be achieved when the insured is made the beneficiary of the process.

Here’s How We Can Be Contacted

Whether you are a program manager who is getting started due to a change in requirements of your carrier/reinsurer, or you are a seasoned user of loss control, we can help. We invite a conversation on how RADAR’s VISUALIZATION process can become your resource for loss control.

We look forward to hearing from you.

Best Regards,

Patrick C. Schneider & The RADAR Team

Today's Implementer Is Tomorrow's Decision Maker